App

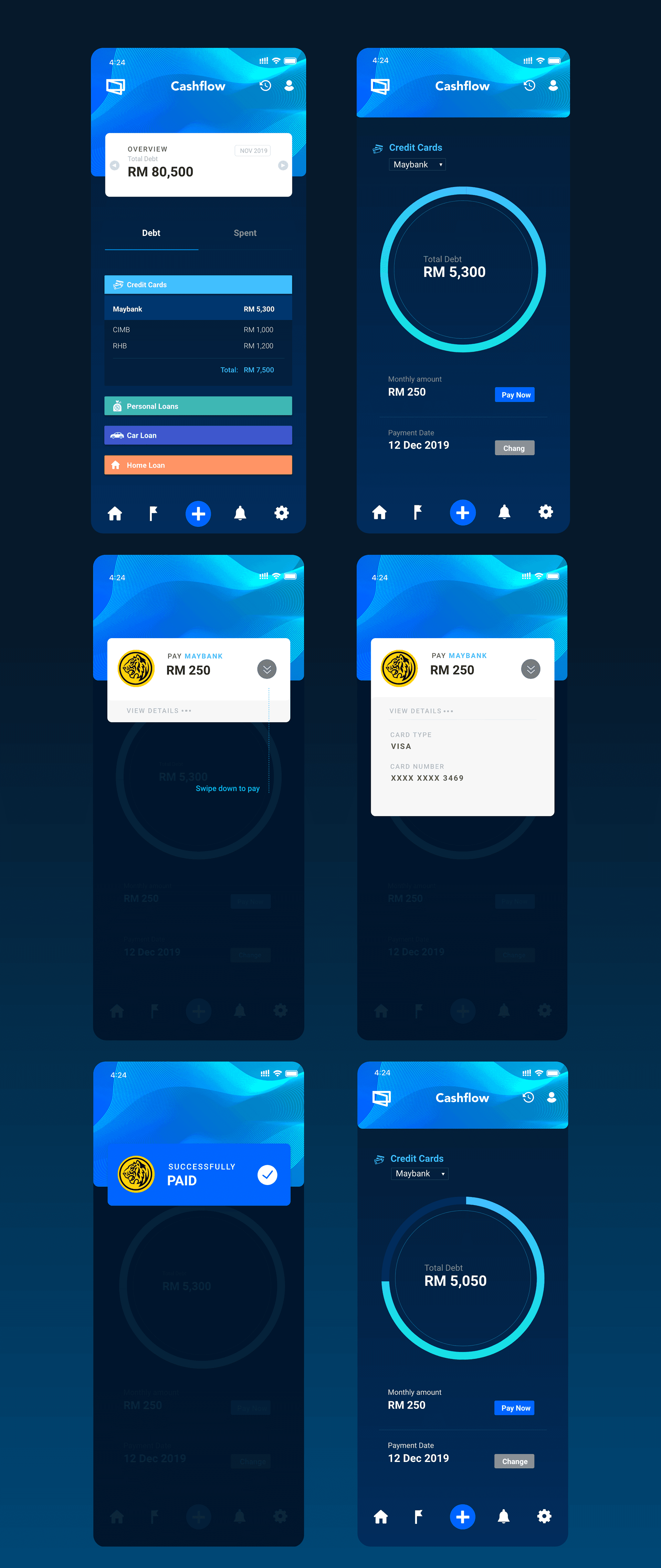

Cashflow Debt Management Concept

Overview

Cashflow is a debt management app designed to simplify the way users monitor and pay their monthly financial commitments. Instead of switching between bank apps, spreadsheets, and manual reminders, Cashflow centralizes all loans, credit cards, and financing obligations into a single, intuitive dashboard. Users can view outstanding balances, track monthly instalments, and make payments directly to respective banks without leaving the app.

Overview

Cashflow is a debt management app designed to simplify the way users monitor and pay their monthly financial commitments. Instead of switching between bank apps, spreadsheets, and manual reminders, Cashflow centralizes all loans, credit cards, and financing obligations into a single, intuitive dashboard. Users can view outstanding balances, track monthly instalments, and make payments directly to respective banks without leaving the app.

Overview

Cashflow is a debt management app designed to simplify the way users monitor and pay their monthly financial commitments. Instead of switching between bank apps, spreadsheets, and manual reminders, Cashflow centralizes all loans, credit cards, and financing obligations into a single, intuitive dashboard. Users can view outstanding balances, track monthly instalments, and make payments directly to respective banks without leaving the app.

Challenge

Most individuals with multiple debts struggle with:

Scattered information across different banking platforms

Lack of visibility on total outstanding balances

Manual tracking using notes or spreadsheets

Missed payment dates and late fees

No consolidated view of financial health

This creates confusion, stress, and poor financial habits.

Cashflow aimed to solve this by providing a single source of truth for all debt-related information and actions.

Goal

Design an app that helps users:

Track all loans, credit cards, and financing plans

Know exactly how much they owe each month

Make payments to multiple banks in one seamless interface

Build healthier financial habits with clarity and automation

Solution

1. Unified Debt Dashboard

A clean, at-a-glance summary of all outstanding balances, upcoming due dates, minimum payments, and total monthly obligations.

The goal: instant clarity.

2. Smart Payment Flow

Users can pay multiple debts from within the app, eliminating the need to jump across banking apps.

The flow prioritizes speed, accuracy, and security.

3. Automated Tracking & Reminders

The app monitors payment status, updates outstanding balances automatically, and sends scheduled reminders so users stay on track.

4. Debt Breakdown & Insights

Each debt is presented with:

Principal amount

Interest rate

Remaining tenure

Payment history

Forecasted payoff timeline

This helps users make informed financial decisions.

Outcome

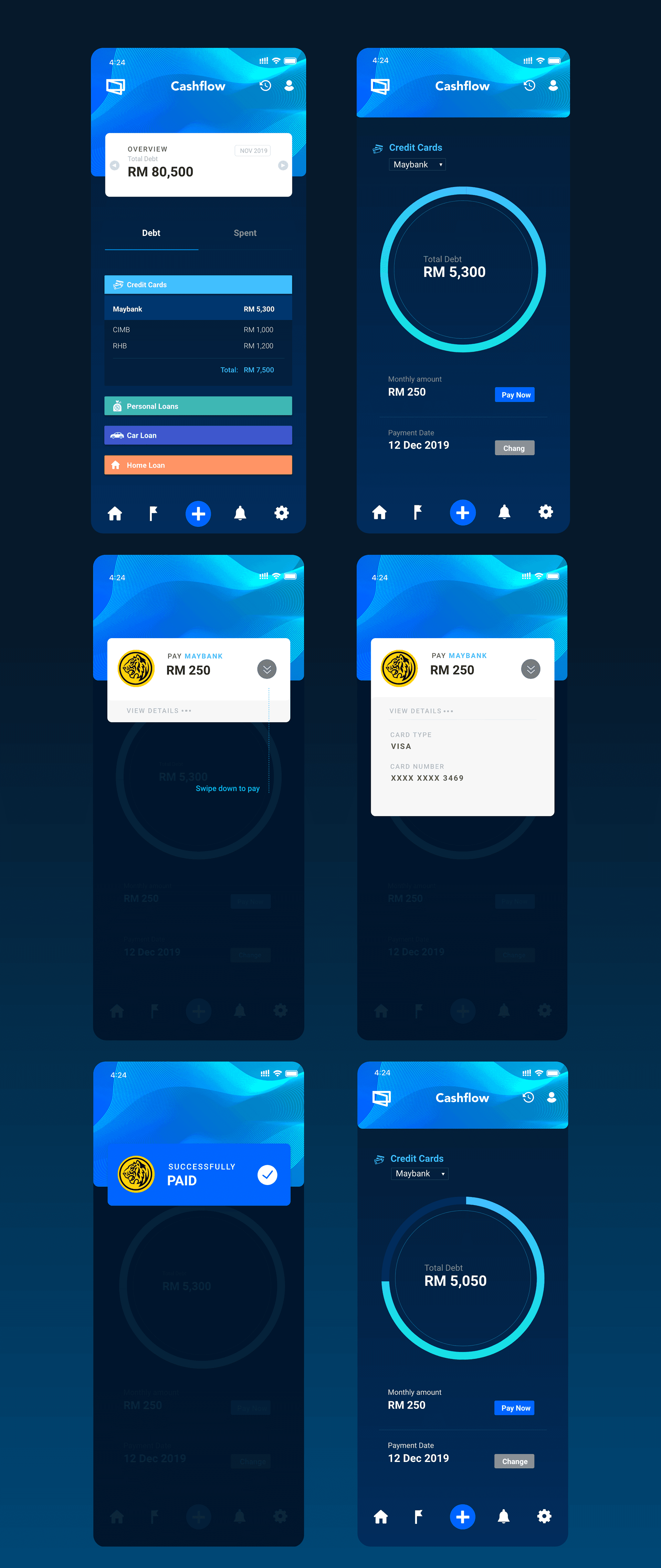

Cashflow transforms a fragmented, stressful financial process into a single, organized, and actionable system.

Users gain:

Immediate visibility of all debts

Fewer missed payments

Less financial anxiety

Better long-term planning habits

Cashflow positions itself not just as a tracking tool, but as a financial wellness companion.

Challenge

Most individuals with multiple debts struggle with:

Scattered information across different banking platforms

Lack of visibility on total outstanding balances

Manual tracking using notes or spreadsheets

Missed payment dates and late fees

No consolidated view of financial health

This creates confusion, stress, and poor financial habits.

Cashflow aimed to solve this by providing a single source of truth for all debt-related information and actions.

Goal

Design an app that helps users:

Track all loans, credit cards, and financing plans

Know exactly how much they owe each month

Make payments to multiple banks in one seamless interface

Build healthier financial habits with clarity and automation

Solution

1. Unified Debt Dashboard

A clean, at-a-glance summary of all outstanding balances, upcoming due dates, minimum payments, and total monthly obligations.

The goal: instant clarity.

2. Smart Payment Flow

Users can pay multiple debts from within the app, eliminating the need to jump across banking apps.

The flow prioritizes speed, accuracy, and security.

3. Automated Tracking & Reminders

The app monitors payment status, updates outstanding balances automatically, and sends scheduled reminders so users stay on track.

4. Debt Breakdown & Insights

Each debt is presented with:

Principal amount

Interest rate

Remaining tenure

Payment history

Forecasted payoff timeline

This helps users make informed financial decisions.

Outcome

Cashflow transforms a fragmented, stressful financial process into a single, organized, and actionable system.

Users gain:

Immediate visibility of all debts

Fewer missed payments

Less financial anxiety

Better long-term planning habits

Cashflow positions itself not just as a tracking tool, but as a financial wellness companion.

Challenge

Most individuals with multiple debts struggle with:

Scattered information across different banking platforms

Lack of visibility on total outstanding balances

Manual tracking using notes or spreadsheets

Missed payment dates and late fees

No consolidated view of financial health

This creates confusion, stress, and poor financial habits.

Cashflow aimed to solve this by providing a single source of truth for all debt-related information and actions.

Goal

Design an app that helps users:

Track all loans, credit cards, and financing plans

Know exactly how much they owe each month

Make payments to multiple banks in one seamless interface

Build healthier financial habits with clarity and automation

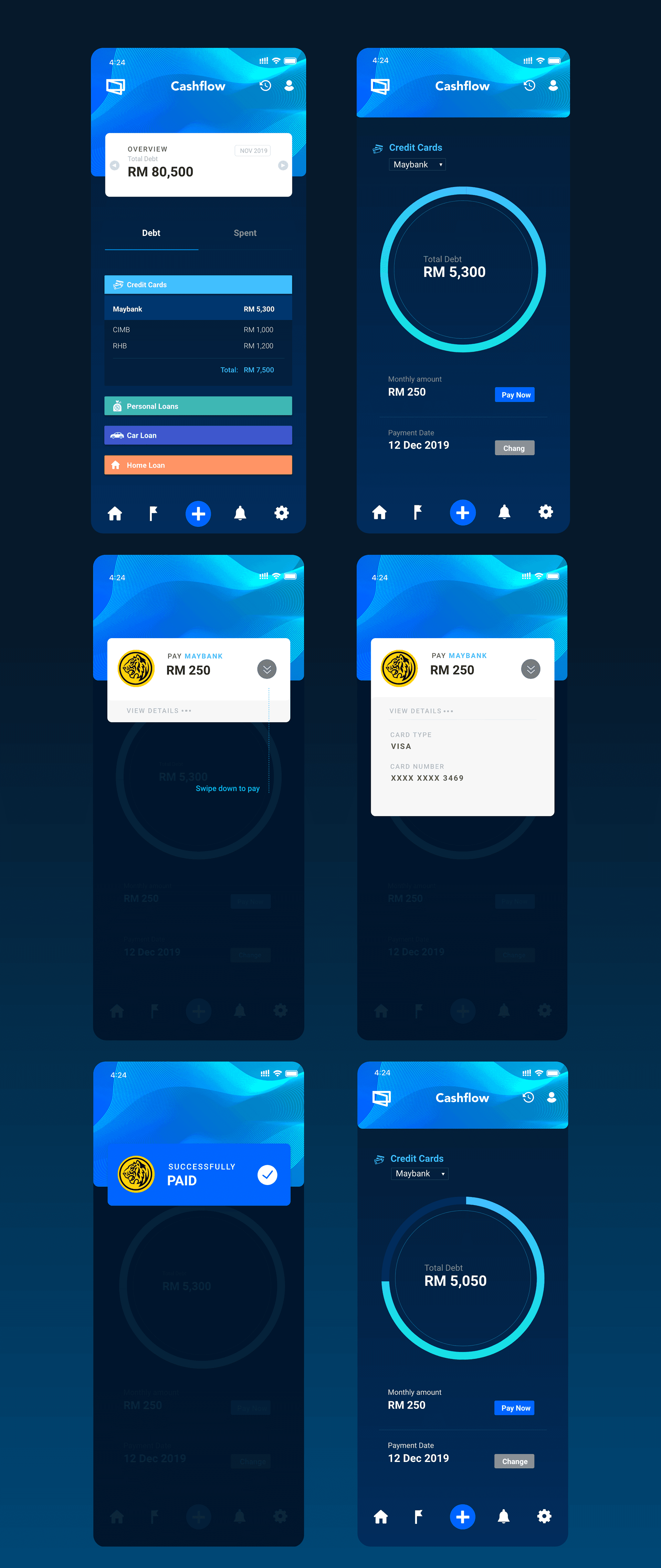

Solution

1. Unified Debt Dashboard

A clean, at-a-glance summary of all outstanding balances, upcoming due dates, minimum payments, and total monthly obligations.

The goal: instant clarity.

2. Smart Payment Flow

Users can pay multiple debts from within the app, eliminating the need to jump across banking apps.

The flow prioritizes speed, accuracy, and security.

3. Automated Tracking & Reminders

The app monitors payment status, updates outstanding balances automatically, and sends scheduled reminders so users stay on track.

4. Debt Breakdown & Insights

Each debt is presented with:

Principal amount

Interest rate

Remaining tenure

Payment history

Forecasted payoff timeline

This helps users make informed financial decisions.

Outcome

Cashflow transforms a fragmented, stressful financial process into a single, organized, and actionable system.

Users gain:

Immediate visibility of all debts

Fewer missed payments

Less financial anxiety

Better long-term planning habits

Cashflow positions itself not just as a tracking tool, but as a financial wellness companion.

Ally Lilith

Currently based in Malaysia · Available for global collaborations. (Timezone MYT/GMT+8)

•

2025 / allylilith.com

•

•

2025 / allylilith.com

•